Instructional Web Application Development using Financial Planning process and Six Jars Money Management System to Enhance Financial Behavior of Lower Secondary Students

Keywords:

Financial Behavior, Financial Planning Process, Six Jars Money Management System, Web ApplicationAbstract

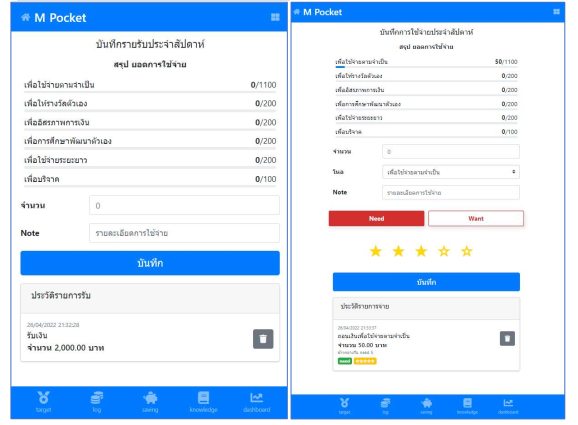

Financial literacy is an essential skill crucial for learners' development. According to the results of the Thailand Financial Literacy Survey conducted by the Bank of Thailand from 2016 to 2020, fostering financial behaviors among learners is imperative. This research aims to (1) develop a web application utilizing the financial planning process and the Six Jars Money Management System to enhance the financial behavior of lower secondary school students, and (2) investigate the effects of this web application on the financial behavior of lower secondary school students. The participants were 60 students selected from lower secondary schools using purposive sampling, and the study spanned a duration of 9 weeks, totaling 81 hours of study. Research instruments included the web application employing the financial planning process, the Six Jars Money Management System, and a financial behavior questionnaire. Data analysis utilized average mean scores, standard deviation, and t-tests. The results revealed a significant difference in students' mean scores on financial behavior before and after using the web application (t(29) = 11.36, p < .001, Cohen’s d = 1.18).

References

ธนาคารแห่งประเทศไทย. (2559). สรุปผลการสำรวจทักษะทางการเงิน (Financial Literacy) ปี 2559. http://doh.hpc.go.th/data/HL/ThaiFinancialSkillSurvey2559.pdf

ธนาคารแห่งประเทศไทย. (2560). รู้รอบเรื่องการเงิน ตอน: วางแผนการเงินอย่างชาญฉลาด. https://www.1213.or.th/Documents/booklet/FCCBooklet03.pdf

ธนาคารแห่งประเทศไทย. (2561). สรุปผลการสำรวจทักษะทางการเงิน (Financial Literacy) ปี 2561. https://www.1213.or.th/th/flsurveyreport/2561ThaiFLsurvey.pdf

ธนาคารแห่งประเทศไทย. (2563). สรุปผลการสำรวจทักษะทางการเงิน (Financial Literacy) ปี 2563. https://www.1213.or.th/th/flsurveyreport/2563ThaiFLsurvey.pdf

ธนาวัฒน์ สิริวัฒน์ธนกุล. (2560). คู่มือ Happy Money Guide ตอน วางแผนการออมสม่ำเสมอ. https://media.setinvestnow.com/setinvestnow/Documents/2020/Nov/10_happy-money-guide-regular-saving-plan.pdf

ปรินทร์ ทองเผือก. (2561). ผลการจัดการเรียนการสอนเศรษฐศาสตร์โดยใช้เกมจำลองสถานการณ์ที่มีต่อการรู้เรื่องการเงินของนักเรียนมัธยมศึกษาตอนปลาย [วิทยานิพนธ์ปริญญามหาบัณฑิต, จุฬาลงกรณ์มหาวิทยาลัย]. CUIR. http://cuir.car.chula.ac.th/handle/123456789/61393

Álvarez, A. B. V., & González, J. R. V. (2017). Financial literacy: Gaps found between Mexican public and private, middle, and high-school students. In M.-S. Ramírez-Montoya (Ed.), Handbook of research on driving STEM learning with educational technologies (pp. 80-106). IGI Global.

Anderson, C., Kent, J., Lyter, D. M., Siegenthaler, J. K., & Ward, J. (2000). Personal finance and the rush to competence: Financial literacy education in the US. Journal of Family and Consumer Sciences, 107(2).

Atkinson, A., & Messy, F.-A. (2012). Measuring financial literacy. https://doi.org/10.1787/5k9csfs90fr4-en

Best, J. W. (1981). Research in education (4th ed.). Prentice–Hall.

CYFI. (2013). Research evidence on the CYFI model of children and youth as economic citizens. CSD Research Review No.13-04.

Eker, T. H. (2005). Secrets of the millionaire mind. Harper Collins.

Fong, E., & Okun, V. (2007). Web application scanners: Definitions and functions. IEEE Xplore. https://doi.org/10.1109/HICSS.2007.611

French, D., McKillop, D., & Stewart, E. (2021). Personal finance apps and low‐income households. Strategic Change, 30(4), 367–375. https://doi.org/10.1002/jsc.2430

Grozdanovska, V., Bojkovska, K., & Jankulovski, N. (2017). Financial management and financial planning in the organizations. European Journal of Business and Management, 9(02). https://core.ac.uk/download/pdf/234627714.pdf

Jazayeri, M. (2007). Some trends in web application development. Future of Software Engineering (FOSE ’07). https://doi.org/10.1109/fose.2007.26

Linnenfelser, M., Weber, S., & Rech, J. (2010). An overview of and criteria for the differentiation and evaluation of RIA architectures. In M. Linnenfelser, S. Weber, & J. Rech (Eds.), Handbook of research on Web 2.0, 3.0, and X.0: Technologies, business, and social applications (pp. 80-106). IGI Global.

Lusardi, Annamaria, and Olivia S. Mitchell. 2014. The economic importance of financial literacy: Theory and evidence. Journal of Economic Literature, 52(1), 5-44.

OECD. (2011). Measuring financial literacy: Core questionnaire in measuring financial literacy. https://www.oecd.org/finance/financial-education/49319977.pdf

OECD. (2016). International survey of adult financial literacy competencies. https://web-archive.oecd.org/2018-12-10/417183-OECD-INFE-International-Survey-of-Adult-Financial-Literacy-Competencies.pdf

OECD. (2017). G20/OECD INFE report on adult financial literacy in G20 countries. https://www.oecd.org/daf/fin/financial-education/G20-OECD-INFE-report-adult-financial-literacy-in-G20-countries.pdf

OECD. (2018). OECD/INFE toolkit for measuring financial literacy and financial inclusion. https://www.oecd.org/financial/education/2018-INFE-FinLit-Measurement-Toolkit.pdf

OECD. (2019). PISA 2018 financial literacy framework. https://www.oecd-ilibrary.org/ education/pisa-2018-assessment-and-analytical-framework_a1fad77c-en

Özmete, E. (2019). Measuring the poverty of elderly people with needs analysis in Turkey. In Information Resources Management Association (Ed.), Socio-economic development: Concepts, methodologies, tools, and applications (pp. 256-276). IGI Global.

Tezel, Z. (2015). Financial education for children and youth. In Zeynep Copur (Ed.), Handbook of research on behavioral finance and investment strategies: Decision making in the financial industry (pp. 69-92). IGI Global.

Thuku, J. K., Maina, E. M., Ondigi, S. R., & Ayot, H. O. (2017). Enhancing learner-centered instruction through tutorial management using cloud computing. In J. Keengwe, & P. H. Bull (Eds.), Handbook of research on transformative digital content and learning technologies (pp. 137-153). IGI Global.

Velozo, R. A. P., & Montanha, G. K. (2017). Evaluation of a Mobile Software Development Company. In L. C. Carvalho (Ed.), Handbook of research on entrepreneurial development and innovation within smart cities (pp. 514-533). IGI Global

Translated Thai References

Bank of Thailand. (2016). Summary of financial literacy survey results year 2016. http://doh.hpc.go.th/data/HL/ThaiFinancialSkillSurvey2559.pdf

Bank of Thailand. (2017). Financial literacy: Smart financial planning. https://www.1213.or.th/Documents/booklet/FCCBooklet03.pdf

Bank of Thailand. (2018). Summary of financial literacy survey results year 2018. https://www.1213.or.th/th/flsurveyreport/2561ThaiFLsurvey.pdf

Bank of Thailand. (2020). Summary of financial literacy survey results year 2020. https://www.1213.or.th/th/flsurveyreport/2563ThaiFLsurvey.pdf

Siriwattanakul, D. (2017). Happy money guide: Regular saving plan. https://media.setinvestnow.com/setinvestnow/Documents/2020/Nov/10_happy-money-guide-regular-saving-plan.pdf

Thongphuak, P. (2018). Effects of economics instruction by using simulation games on financial literacy of upper secondary school students [Master’s thesis, Chulalongkorn University]. CUIR. http://cuir.car.chula.ac.th/handle/123456789/61393

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 The Authors

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

All published content in JRM is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License (CC BY-NC-ND 4.0).